Social Security Income Limit

Working and Social Security

Payments at Full Retirement Age

What IS the Social Security Income Limit?

Have you considered working and collect Social Security, at the same time, to boost your spendable income? You could pay off debt, credit cards, or get new appliances or a new car, before you actually retire.

Have you considered the concept of living on your working wages, but instead of spending the Social Security income, sock it away for a rainy retirement day? You could put your Social Security payments into savings (direct deposit), for the future, not for today while you still have a working income. Just think, later you'd have fun money, help with financial issues, help with your bills, whatever.

Have YOU ever considered DOUBLE DIPPING ?

It's legal!

Just work and draw Social Security at age your

"full retirement age".

What IS Your Full Retirement Age?

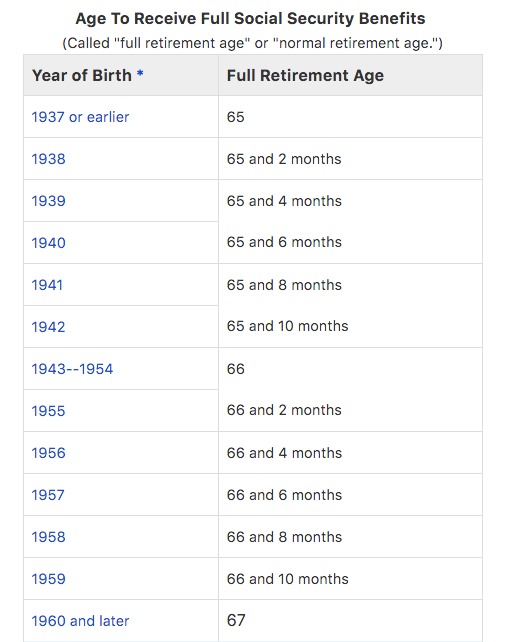

Just look at the table to the right. and find your birth year, SIMPLE!

They are gradually increasing the full benefit age from 65 to age 67 for benefit cost issues.

As with much nowadays, it used to be much simpler... but it is what it is!

Before Full Retirement Age

Social Security earnings limit is $15,720 for 2016, if you are working and collecting your Social Security payments. If you earn over $15,720, you lose $1 for every $2 you earn, after you hit the maximum.

That sounds bad and you do lose half of the SS payment over the earnings limit BUT you still get full Social Security for the first $15,480. in wages earned, and then half of your Social Security for the rest of the year (assuming you work over their limit). Right?

It will really help you, long term, if you don't take it early, when you are still working. If you wait, you get the higher Social Security payment which will last you for the rest of your life. However, for some folks, paying off some of your debt may help greatly as you have less payments in retirement, when you have less income, and the the peace of mind itself may be well worth it. It's a personal decision.

In the year you reach Full Retirement Age, Social Security will deduct $1 in benefits for every $3 you earn above a different limit. In 2016, the limit on your earnings is $41,880 but only earnings before the month you reach your full retirement age are reduced.

Full Retirement Age

There is no Social Security earnings limit.

Age 66 is your "full retirement age" so that folks CAN continue to work and draw Social Security also.

You can wait longer to get to your "full retirement age" and full benefit payment -- but you can also consider drawing a Social Security benefit at age 66 - whether retired or still working.

You can continue to work and live on your working wages -- and save the

Social Security payments for later, when you aren't working and need some extra

cash. Every year, they recalculate your benefit and increase it due to your

earnings the previous year.

For example, at $1000/month Social Security -- you'd have $12,000 in your savings account in a year (actually, you likely won't have quite that amount because of taxes, depending on your income, but still a nice amount to add to savings in just ONE year!)

One gal I worked with has traveled the world, having the time of her life, with her Social Security monies, and she lives on her working wages.... what fun! She saves it all year and then takes one BIG vacation.

Now - Her home is paid off, so she CAN use these monies for travel. She is having FUN at 70+ and has been doing this for years. She isn't ready to retire, she loves her job, and using her vacation time, she travels anywhere she can get a good deal -- all on her Social Security savings account!

More on Social Security Benefits here!

Senior Voices - Experience retirement living through the voices of our readers!